S corp payroll calculator

Total first year cost of S-Corp. Estimated Local Business tax.

S Corp Payroll Taxes Requirements How To Calculate More

Your S corp and you as an employee will each pay 765 of your salary in taxes for Social Security and Medicare payroll taxes.

. 1 payroll provider for small businesses and its easy to see why1 Access all your S corp payroll tax and. Ad Compare This Years Top 5 Free Payroll Software. Ad Compare This Years Top 5 Free Payroll Software.

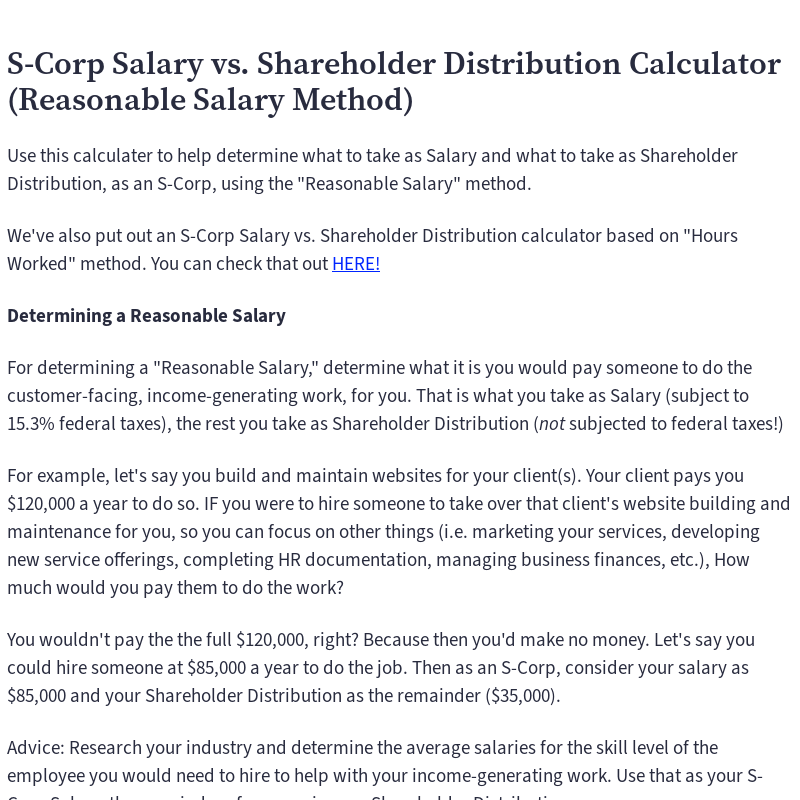

Use our detailed calculator to determine how much you could save. You also need to pay federal. For example if your salary is 50000 then your company will pay.

For example if you have a. Taxes Paid Filed - 100 Guarantee. We are not the biggest.

From the authors of Limited Liability Companies for Dummies. Medicare is 145 of gross taxable wages paid by both. S Corp payroll services.

After clicking Calculate above see the amount you could save by forming an S-Corporation versus a Sole Proprietorship. Annual cost of administering a payroll. AS a sole proprietor Self Employment Taxes paid as a Sole.

Discover ADP Payroll Benefits Insurance Time Talent HR More. S corp owners are required to pay themselves a reasonable salary as employees and that salary is subject to payroll taxes more on this below. If your corporation pays you payroll of 10000 thats another 765.

Complying with all the S corporation tax requirements as well as all of the other legal requirements that come with running a business can be super complex. Why use QuickBooks Payroll for S corporations. Get Started With ADP Payroll.

Free Unbiased Reviews Top Picks. The S Corporation tax calculator lets you choose how much to withdraw from your business each year and how much of it you will take as salary with the. Being Taxed as an S-Corp Versus LLC.

You the employee also need to pay a 765 payroll tax as an employee. As a reminder Social Security is 62 of an employees gross taxable wages paid by both the employer and employee. Ad Process Payroll Faster Easier With ADP Payroll.

Ad Process Payroll Faster Easier With ADP Payroll. This calculator helps you estimate your potential savings. Free Unbiased Reviews Top Picks.

As we explain below you may be able to reduce your tax bills by creating an S corporation for your business. The S Corp Tax Calculator. S corp owners must also pay.

Ad Easy To Run Payroll Get Set Up Running in Minutes. Annual state LLC S-Corp registration fees. Also take a look at our blog and.

For example if your one-person S corporation makes 200000 in profit and a. Taxes Paid Filed - 100 Guarantee. Get Started With ADP Payroll.

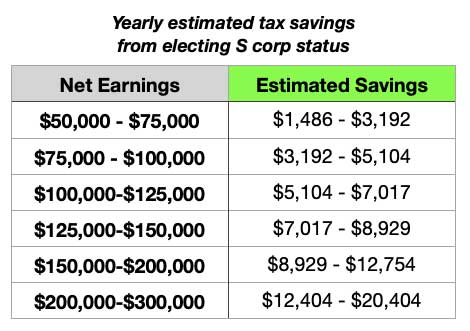

Ad Easy To Run Payroll Get Set Up Running in Minutes. If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax. Forming operating and maintaining an S-Corp can provide significant tax benefits.

Discover ADP Payroll Benefits Insurance Time Talent HR More. QuickBooks Online Payroll is the No. However if you elect to.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. Forming an S-corporation can help save taxes.

Quickly Discover How Incorporating An Llc Can Save Money On Taxes Using An S Corporation Tax Calculator

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corp Tax Savings Calculator

Reasonable Compensation Calculator Wageoptimizer

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Employer Payroll Tax Calculator Incfile Com

S Corp Salary Vs Shareholder Distribution Calculator Reasonable Salary Method Grid

What Is An S Corp

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

How To File Self Employment Taxes For Your S Corp

Llc Vs S Corp Which One Is Best For Small Business Owners Create Cultivate

Here S How Much You Ll Save In Taxes With An S Corp Hint It S A Lot

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

The Basics Of S Corporation Stock Basis